The Quantitative Revolution in Private Markets

The path toward increased adoption of private investments within diversified investment portfolios will be paved by quantitative technology that integrates public and private markets

In a way, Blackrock’s recent acquisition of Preqin has vindicated my 6 year journey to combine public and private market investing, and is simply one additional data point highlighting that the path toward greater adoption of private investments within broad diversified investment portfolios will be paved by quantitative technology that integrates public and private markets.

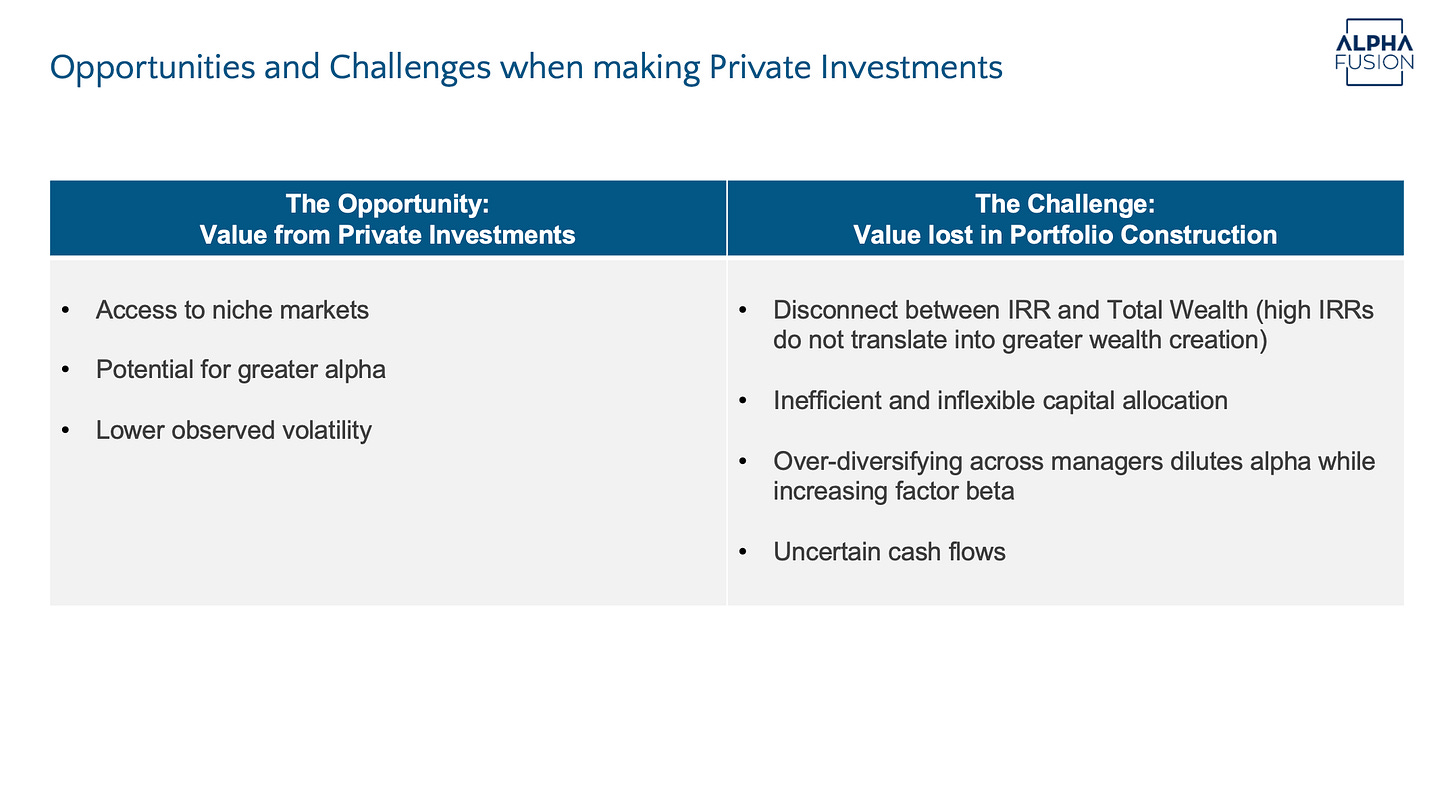

LPs recognize both the value that private markets bring to their portfolio (access to niche markets, potential for greater alpha, lower observed volatility) and the challenges they face when allocations to private assets become material (disconnect between IRR and actual wealth created, inflexible and inefficient capital allocation, over-diversifying across managers dilutes alpha, uncertain cash flows).

We are now at a point where most private market investors recognize these challenges and are seeking solutions.

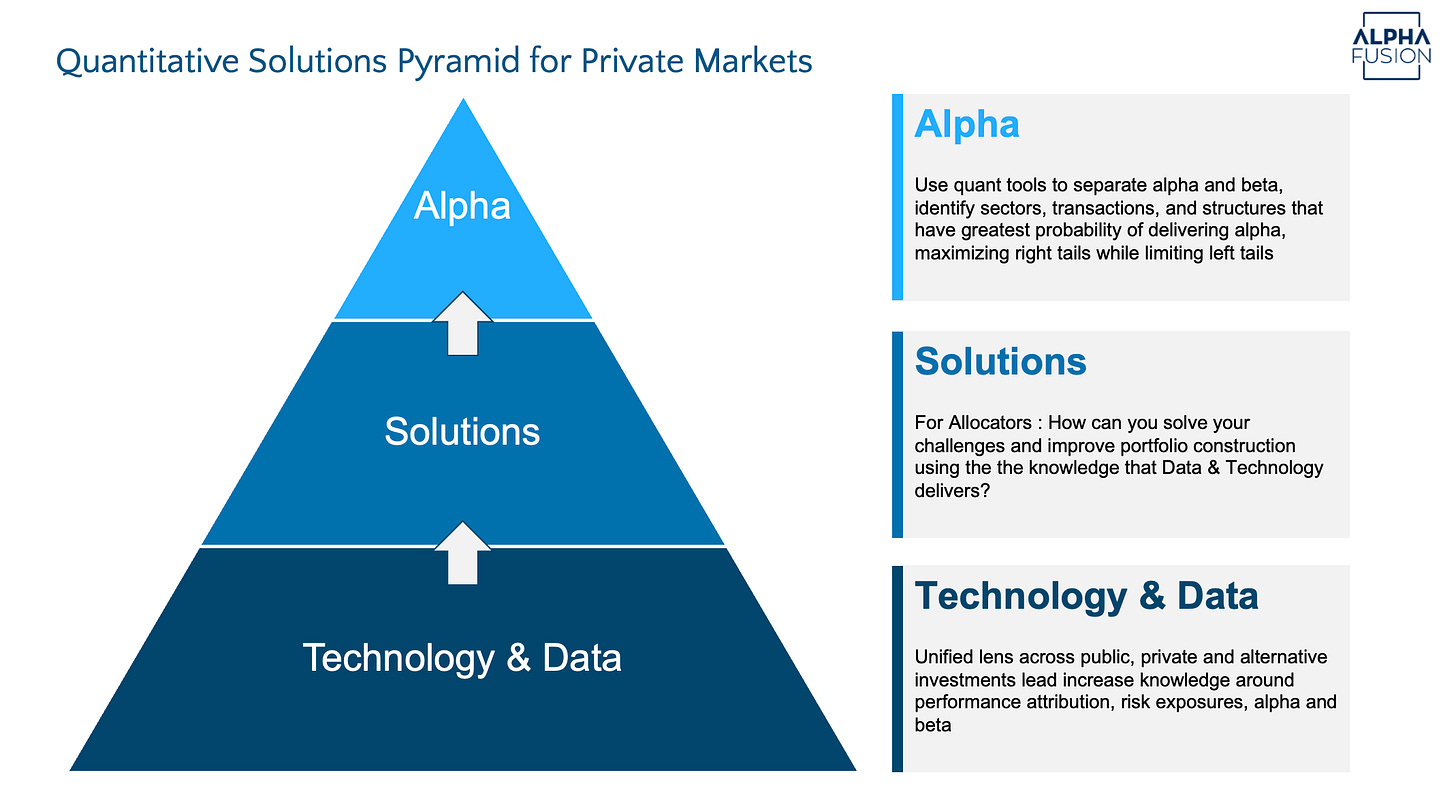

Quantitative technology can deliver the knowledge, solutions and alpha that LPs need.

There are three stages of evolution in the use of quantitative technology to improve investor outcomes from private investing. The first is Technology & Data, which then leads to better Solutions, and ultimately helps generate Alpha.

Technology & Data is low-hanging fruit, and the foundation upon which solutions and alpha generation can be built. The integration of public and private market technology is already underway, even though it still has a lot further to go. Providers such as Venn by Two Sigma have taken the first step by applying a factor lens toward public and private funds. Blackrock will undoubtedly look to do something similar with Preqin and Aladdin. These are still baby steps, but should eventually lead to standardized metrics to evaluate public and private investments side by side, and within a total portfolio. For the moment, I have built my own tools to integrate public and private, and painfully gather, clean and use data to convert private performance measures into ones that are relevant for portfolio construction, asset allocation, and alpha/beta separation. But in the future, I expect technology to streamline the process and make such analysis more commonplace.

Solutions are the next step - use the knowledge from technology & data to solve an LP’s challenges. Knowing factor exposures, macro sensitivity, cash flow, total wealth, alpha and beta can help build superior portfolios that combine private and public strategies for LPs. Asset managers that have multiple private offerings can design custom portfolios that can optimize the private recommendation based on what can be sourced from public markets. Multi-strategy approaches that connect public, private and hedging/diversifying strategies to solve LP challenges become appealing, and implementable.

Alpha is at the top of the pyramid. Tools to better identify relative value between similar public and private opportunities can help identify superior alpha opportunities between public and private markets, both at a fund level and at a deal level. Statistical, Machine Learning, and LLM tools can separate alpha and beta, identify sectors, transactions, and structures that have the greatest probability of delivering alpha. Systematic approaches to investing can maximize right tails while limiting left tails.

What enables better private investing is not fancy technology, but rather the breaking down of barriers that have separated various asset classes and strategies. Public and Private markets share common factors, as do asset classes - equity, credit, real estate and even infrastructure share several common exposures. Recognizing the common factors, and quantifying the differences can lead to improved portfolio construction and total portfolio alpha generation.

Firms such as Alpha Fusion are building solutions and investment strategies that LPs can use to improve their total portfolio outcomes, and I am excited about being at the vanguard of this revolution.

LPs will be the ultimate beneficiaries of this revolution, but the quantitative revolution can also be highly beneficial to the asset managers who embrace a quantitative mindset.

Historical Context: The hedge fund industry provides a case study of this shift

About a decade ago, with increased adoption by LPs and consultants of tools such as SEI’s Novus, and Barra/Axioma factor models, LPs were better able to separate alpha and beta in their hedge fund books. This led to a better understanding of which managers were generating alpha. Quantitative hedge funds such as Two Sigma, DE Shaw saw an increase in their AUM, as did multi-strategy funds such as Millennium, where the use of multiple ‘pods’ of alpha combined with a centralized risk management function to manage beta led to superior alpha generation. Hedge Funds that were slow to adapt have died a slow death. Ones that have embraced the approach, and in some cases even partnered with large LPs on technology (e.g., Walleye’s Dockside platform) have seen not only AUM growth, but also improved on the alpha delivered to their LPs

Becoming a Better Fiduciary is Good for LPs and Profitable for GPs.

As private investments expand from large institutions into retirement and wealth management, quantitative approaches to portfolio solutions will become essential to delivering superior outcomes to the millions of individuals whose capital is ultimately at risk. It's an exciting time for LPs and can be highly profitable for the asset managers who embrace this inevitable revolution.